Last Updated: February 1, 2025

Retainage is a portion of a contractor’s payment withheld until project completion that serves as a safeguard for quality and compliance. While it’s a cornerstone of successful construction projects, mishandling retainage can lead to financial strain and project delays.

Did you know that retainage delays can tie up 5–10% of project funds for months, impacting cash flow for over half of construction firms? Effectively managing retainage is critical for staying financially secure and keeping projects on track.

Whether you’re a contractor, construction manager, or project owner, this blog is your go-to resource for mastering retainage. Let’s get started.

What is Retainage in Construction?

Retainage, a common practice in construction contracts, involves withholding a portion of the total payment, typically 5–10%, until the project’s completion. This practice ensures contractors meet agreed-upon quality and timeline standards.

By holding back retainage, project owners maintain leverage to guarantee satisfactory work. Retainage is typically released after final inspections and approvals, providing a layer of protection for clients against incomplete or substandard work.

Why Retainage is Crucial for Quality Assurance and Risk Management

- Ensures Quality: Retainage motivates contractors to deliver work that meets expectations.

- Mitigates Risk: It reduces the likelihood of incomplete or unsatisfactory performance.

- Encourages Compliance: Contractors and subcontractors are more likely to comply with contract terms.

Common Retainage Practices

- Retainage percentages (usually 5–10%) are agreed upon in the contract.

- Subcontractors are often subject to retainage.

- Funds are only released after final inspections and approvals.

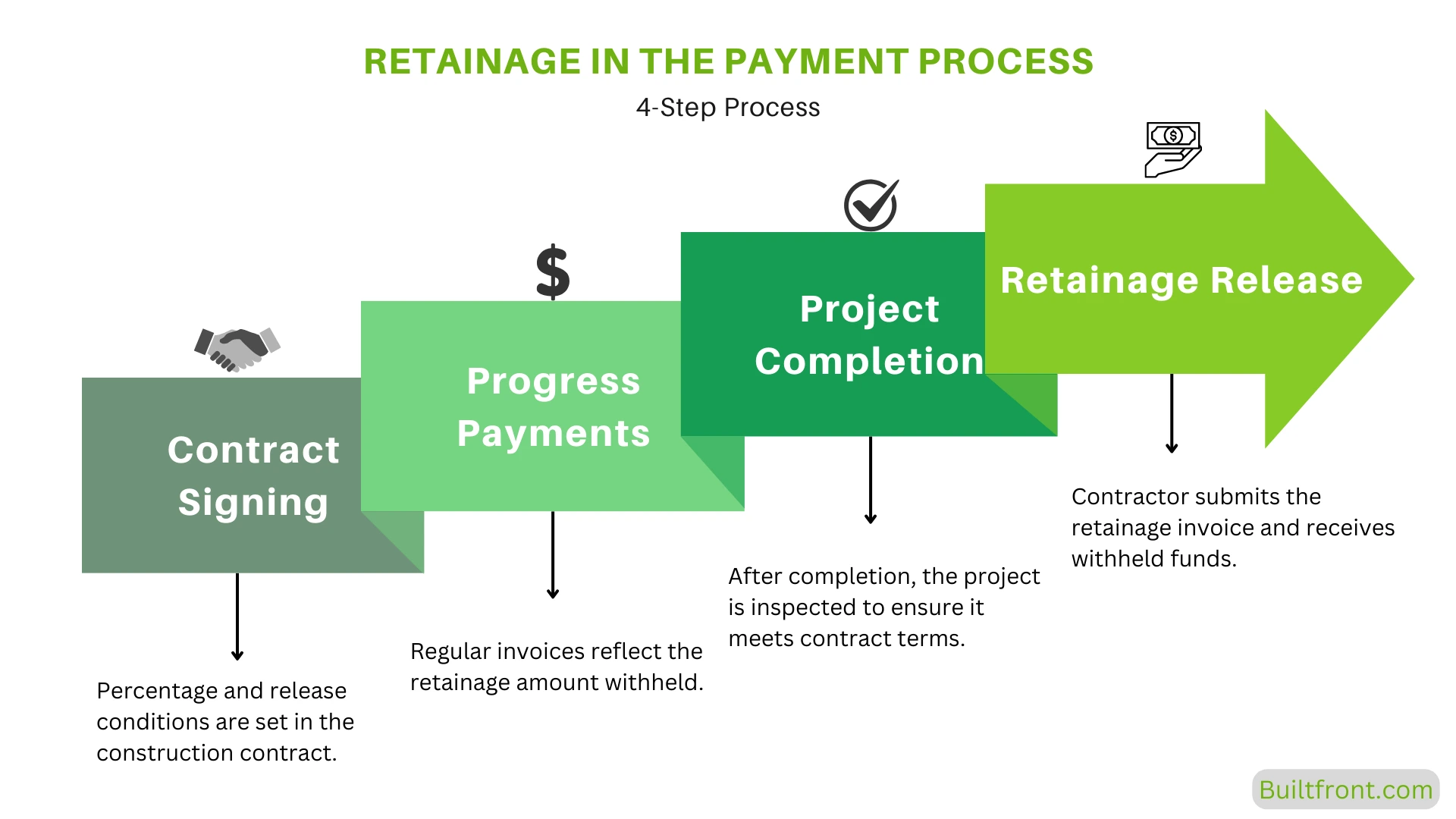

Retainage Payment Process:

The Billing Process for Retainage

Billing for retainage requires close attention to contract terms and precise documentation. Here’s a step-by-step guide:

Step 1: Review Your Contract

Understand the retainage percentage, payment schedule, and conditions for release. Contracts often specify how retainage should appear on invoices.

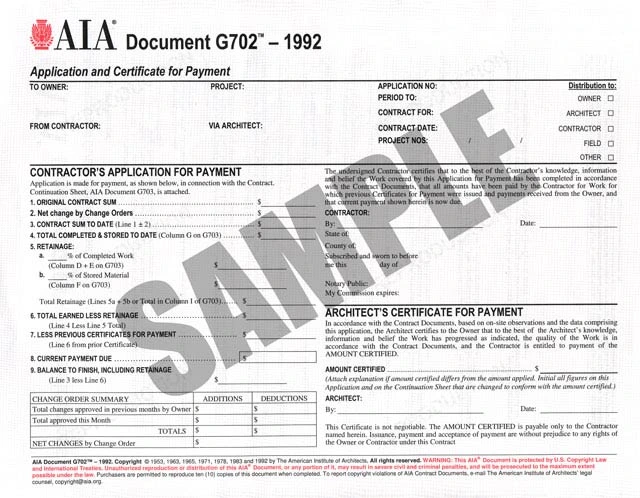

Step 2: Prepare Accurate Invoices

Include retainage deductions in each invoice. For instance, use AIA Form G702, which allows you to clearly outline progress payments and retainage amounts.

Step 3: Submit Final Retainage Invoice

Once the project is completed and approved, issue a separate invoice for the retained amount to ensure prompt payment.

Tools to Simplify Billing

- Construction management software (e.g., Builtfront).

- Accounting platforms like QuickBooks for retainage tracking.

Accounting for Retainage: Best Practices

Recording Retainage in Financial Statements

Retainage must be tracked properly to reflect its impact on your business:

- Retainage Receivable: For contractors awaiting payment.

- Retainage Payable: For clients holding back funds.

Using Accounting Software

Platforms like QuickBooks allow you to set up dedicated retainage accounts. This ensures clear records for tax filing and financial reporting.

Tax Considerations

Retainage may impact revenue recognition. Consult a financial advisor to ensure compliance with tax laws.

Best Practices for Managing Retainage in Construction

Negotiating Favorable Retainage Terms

- Request a lower retainage percentage (e.g., 5% instead of 10%).

- Negotiate partial releases upon milestone completions.

Communicating Clearly

- Keep clients and subcontractors informed about retainage terms.

- Document all communications to avoid disputes.

Ensuring Compliance

Follow contract terms meticulously to avoid delays in retainage release.

Common Mistakes and How to Avoid Them

Handling retainage can be challenging. To help you stay on track, here are five common mistakes and practical solutions to avoid them.

| Mistakes | Solution |

|---|---|

| Failing to Bill Retainage Promptly | Submit retainage invoices immediately after project approval. |

| Poor Documentation | Use clear, consistent formats for invoices and retainage terms. |

| Mismanaging Subcontractor Retainage | Align subcontractor agreements with the main contract’s retainage terms. |

| Not Keeping Track of Retainage Receivables | Regularly monitor retainage payments and receipts to avoid discrepancies. |

| Failing to Follow Up on Retainage | Stay proactive by following up with clients or owners on outstanding retainage payments. |

Learn more: How to Track and Improve Project Progress for Builders.

The Impact of Retainage on Cash Flow

Retainage can strain cash flow, especially for contractors who must pay suppliers and labor while awaiting final payments.

Tips to Mitigate Cash Flow Challenges

- Invoice Promptly: Ensure all payments, including retainage, are billed on time.

- Plan Ahead: Include retainage timelines in your cash flow projections.

- Build Reserves: Maintain a buffer to cover expenses during retainage delays.

Legal Considerations Around Retainage

Retainage laws vary by state, with some capping retainage percentages or mandating timely releases. Understanding these regulations is critical to avoiding legal issues.

| State | Maximum Retainage Rate | Conditions for Release | Retainage Timelines |

|---|---|---|---|

| California | 5% for public projects, reduced after 95% completion | Retainage may be reduced after 95% of the work is complete. | Retainage must be released within 45 days of project completion. |

| Florida | 10% for public projects, reduced to 5% after 50% completion | Retainage reduction after 50% completion. | Timely release of retainage required after 50% work completion. |

| Connecticut | 7.5% for initial work, 5% after 50% completion (public), 5% for private | Retainage reduced after 50% of work completion. | Timely release for all contracts within statutory guidelines. |

| Colorado | 5% for public contracts over $150,000 | Contractor may substitute securities instead of retainage. | No specific timeline, but must be reasonable. |

| Delaware | 5% for public projects | 60% of retainage released upon completion, balance after approvals and payments to subcontractors. | Timely release once all conditions met. |

| New Mexico | No retainage allowed on most projects | N/A | N/A |

| Arkansas | 5% for public projects | Contractors can substitute securities in lieu of retainage. | No specific timeline, but payment conditions must be met. |

Key Points to Know

- Some states limit retainage to 5% of contract value.

- Contractors can pursue legal remedies if retainage is unfairly withheld.

How Construction Software Helps with Retainage

Managing retainage doesn’t have to be complicated. With the right software, you can automate key tasks like tracking payments, creating invoices, and ensuring that retainage terms are followed according to the contract. These tools make it easier for contractors and project managers to stay on top of retainage percentages, set up payment schedules, and avoid mistakes.

Construction software like Builtfront simplifies the retainage process by offering real-time updates, reducing the chance of errors. Builtfront’s features also help with client management, ensuring clear communication and timely updates on project status and payments. This not only helps ensure payments are made on time but also reduces administrative work, so you can focus on what matters most—keeping your project on track.

Looking for a smarter way to manage retainage and improve client management? Builtfront offers features designed to streamline your construction project management, payment tracking, and client communications, making retainage easier to handle.