Last Updated: October 29, 2025

As a contractor, it’s an absolute must to understand your general contractor markup percentage so as to maintain profitability and competitiveness. Markup is more than merely covering your costs. It also covers your overhead, risk, and profit to keep your business running.

No matter if you’re invoicing your subcontractors, using an equation to come up with it, or going over typical percentages from project to project, knowledge of how markup works enables quality work while protecting your bottom line.

Table of Contents

What is general contractor markup?

What is general contractor markup? It’s the percentage contractors put on labor, material, and other costs of a project to come up with the final price paid by the client. The percentage adds in overhead such as business expenses, project management, and risk and builds in profit too. It’s standard in construction, and being aware of it removes common misconceptions.

Markup vs Profit Margin Comparison

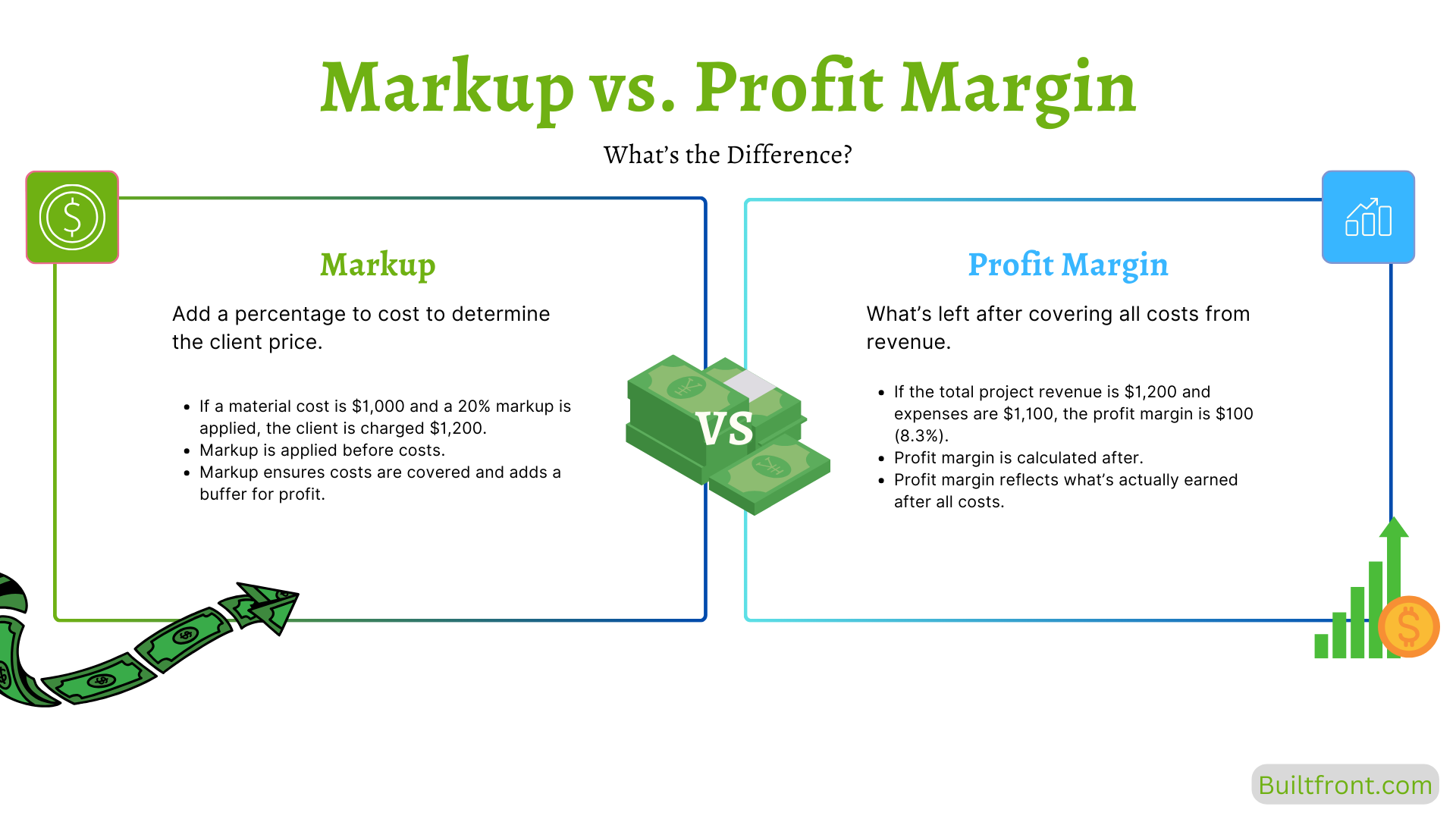

Many contractors confuse markup with profit margin, but they are not the same:

- Markup is the percentage rate put on a project’s costs so expenses are covered and profit is achieved.

- Profit Margin is the amount of revenue left as profit when all costs have been paid.

Example

If materials cost $1,000:

- Markup: The contractor marks up $1,200 with a 20% markup ($200).

- Profit Margin: If total costs are $1,100, then the profit margin is 8.3% ($100 profit ÷ $1,200 revenue).

Top tip: Markup ensures you recoup costs and gain profit, while profit margin is what’s left over when all your costs have been covered.

Learn more: Markup vs. Margin: A Quick Guide for Construction Pros.

Average General Contractor Markup Percentage

The general contractor average markup varies with the type of project, degree of complexity, and location of the project. Markup is applied to costs, covers overhead, and contributes to profit. The general contractor % average markup generally falls within the following ranges:

- Residential projects: 10–15%

- Commercial projects: 15–20%

- By trade: Varies (see markup on subcontractors below)

Construction Financial Management Association (CFMA) data shows contractors’ pre-tax profit margin rose in 2023 to 6.3% from 5% the year before. Subcontractors, who specialize and perform a large share of work, often enjoy slightly better margins due to efficiency and niche expertise.

Typical Markup by Project Type

| Project Type | Typical Markup Range |

|---|---|

| Residential | 10–15% |

| Commercial | 15–20% |

| By Trade/Subcontract | Varies by specialty |

General Contractor Markup on Subcontractors

Marking up subcontractor work is standard business practice. This covers overhead, management time, and the risk a general contractor assumes. Without it, coordination risks and costs would directly eat into profit.

Typical Subcontractor Markup Ranges

- Standard trades: 10–15%

- Specialized trades: Up to 20%

Example

If a subcontractor charges $10,000 for electrical services, a GC may apply a 15% markup. The client is billed $11,500. This ensures compensation for project oversight, communication, and risks tied to subcontractor work.

Transparency with clients about subcontractor markup prevents confusion and emphasizes the value you provide.

General Contractor Markup Formula (Step by Step)

Formula:

Final Price = Subcontractor Cost × (1 + Markup %)

Example:

If labor costs $5,000 and you apply a 20% markup:

$5,000 × 1.2 = $6,000

You can also use a markup calculator for quick, accurate pricing that ensures overhead and profit are covered.

Typical Markup in Construction by Trade

Markup varies by trade due to differences in labor, materials, licensing, and project complexity:

Electrical:

10–15% on materials; labor may be higher depending on complexity and location.

Plumbing:

15–25%, due to licensing, complex installs, and higher risks.

General Labor:

10–20%, depending on the region and type of work.

Why Contractors Need a Markup to Stay in Business

A general contractor markup is essential for a contractor’s financial health. It ensures you can cover project costs, pay employees, and prepare for unexpected challenges while generating profit.

Typical areas covered by contractor markup on subcontractors and other costs include:

- Cover overhead (rent, utilities, insurance, admin salaries).

- Absorb unexpected risks (site issues, delays, scope changes).

- Generate profit for sustainability and growth.

- Manage contingencies for unexpected increases in labor or materials.

Bottom line: Applying the right markup keeps projects on budget and your business secure.

Learn more: Construction Contingency 101: Everything You Need to Know

Build Your Business Smarter with Builtfront

For contractors, general contractor markup education is essential to staying competitive and profitable in today’s fast-paced marketplace. Knowing how to calculate and communicate your markup, in turn, enables you to meet client expectations, stay transparent, and gain credibility.

By employing a construction management tool such as Builtfront, can actually assist builders like yourself with streamlining your project management and increasing your bottom line. It has everything from team management through to tracking your projects in real time. With such features as budget tracking, invoicing, and seamless communication with your client and your subcontractors, you’ll be better organized and your projects should continue to go smoothly.

Builtfront makes it simple to do away with administrative headaches with document storage and workflow automation, so more time is devoted to doing what matters –– getting the job done right.

Take your business to the next level. Start with Builtfront free today and discover how our software can help with streamlining your processes, increasing profitability, and speeding your growth.

FAQs About Contractor Markup

What is the average markup for a general contractor?

10–20%, depending on project type and location.

How do contractors calculate markup?

By adding a percentage to costs. Example: $10,000 invoice + 15% = $11,500.

What’s the difference between profit margin and markup?

Markup is added to costs; margin is profit left after expenses.

Do contractors apply markup on subcontractors?

Yes — it covers overhead, risk, and coordination.